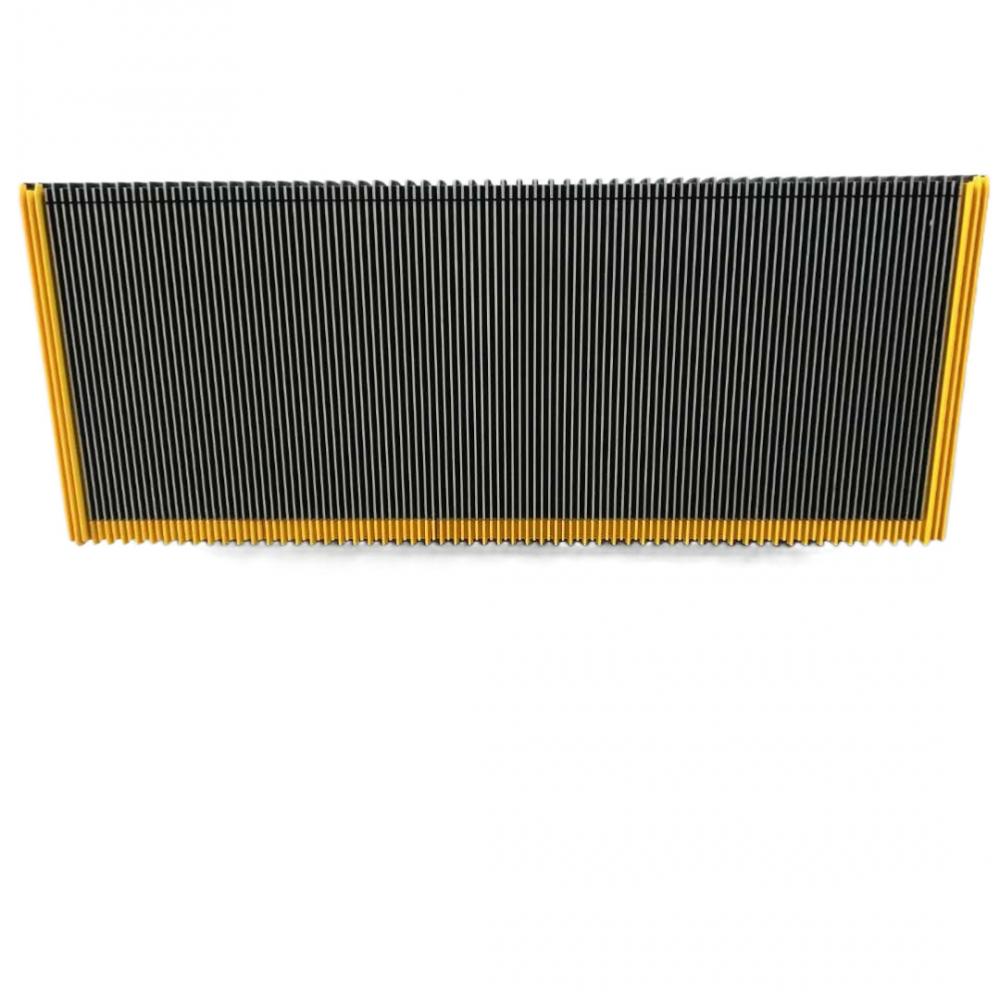

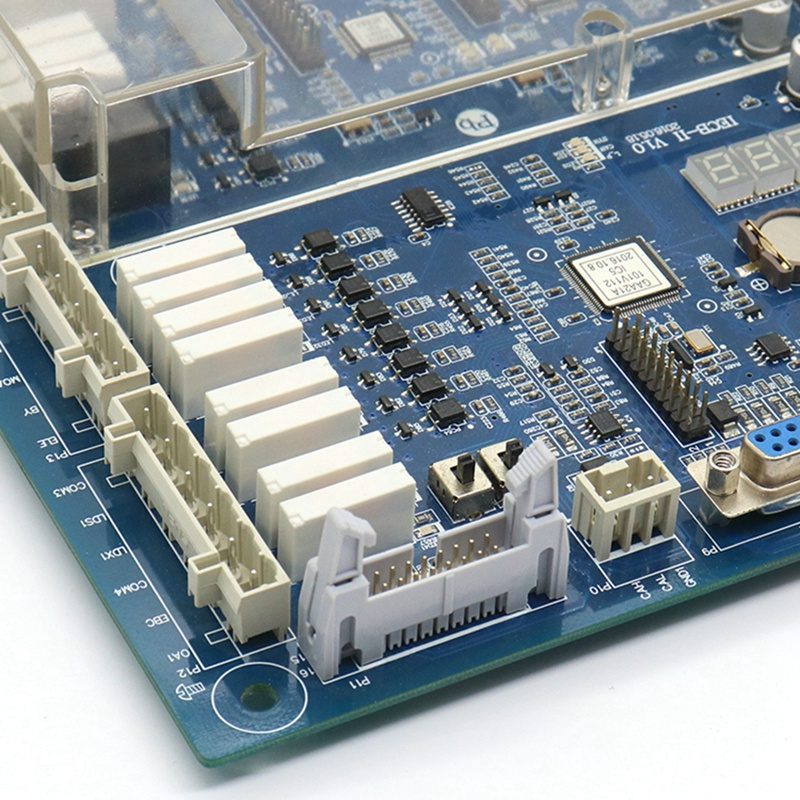

We can provide all kinds of accessories for OTIS escalators.

Including: Demarcation Strip, Sidewalk Pallet, Aluminium Step, Chain Roller, AI Drive Roller, AI Bearing Step Roller, Roller, Iron Hub, Press Roller, Wearing Strip, Gliding Bushing, Comb Plate, Step Chain, etc.

Some products may not appear in our product list, but you are welcome to inquire with product pictures and specific parameters.

OTIS Escalator Spare Parts,OTIS escalator spare parts,OTIS escalator accessories,OTIS escalator Suzhou Keffran Parts Co.,ltd , https://www.keffran-elevatorsmart.com

From the "two loses and hurts" to the "one arrow and two sculptures", the Henan State-owned Assets Supervision and Administration Commission has added additional funds to the new and new materials, and the essence is "one arrow and two sculptures." The so-called "one arrow and two sculptures", one is to increase the concentration of the main products, and the other is the wish to go public. According to the announcement of asset restructuring, by reorganizing Dongfeng's integrated resources, Yicheng New Materials, once the completion of the additional issuance, its market share of photovoltaic cutting blades will reach 40%, which will not only become the industry's highest market share. And the bargaining power of downstream chip manufacturers will be significantly enhanced. Obviously, once the "double male hegemony" has to evolve into "outstanding", once the industry picks up, Yicheng new material future profits can be expected. On the other hand, the additional issuance also ended the wish of Yicheng new materials. “In the layout of the Henan State-owned Assets Supervision and Administration Commission, Pingmei Shenma and Shenhuo Group are the main lines of energy development. Shenhuo is a traditional energy source, Pingmei Shenma is a new energy source, Shenhuo shares under Shenshen Group have been listed, and Pingmei’s Yi Cheng new materials have been listed, and have been planning," the analyst told reporters. In fact, in the list of backup companies listed in Henan Province, Yicheng New Materials was included in the first batch and was originally scheduled to be listed within two years. However, after years of fierce competition with Xinda New Materials, the two companies actually suffered “two lossesâ€, the performance of new and new materials fell sharply, and the stock price went all the way. Yicheng’s new material was broken. If it seeks to go public, it will have a lot of resistance. . According to the restructuring announcement, Yicheng New Materials realized revenues of 3.024 billion yuan and 2.152 billion yuan in 2010 and 2011 respectively, and net profit of 155 million yuan and 73.641 million yuan, a significant downward trend. In the first three quarters of this year, Yicheng New Materials' operating income and net profit were only 497 million yuan and 20,847,500 yuan. Obviously, it is very difficult to report IPOs to regulators with such performance. The major shareholder escorts, Guoxin Hongsheng has a foothold. New big new materials have to change from private enterprises to state-owned enterprises. In addition to the Henan Provincial State-owned Assets Supervision and Administration Commission, PE will also take a share in this capital feast. Among them, as many as 11 PEs are piled up into new materials. Yicheng New Materials was established in 1996 and reformed at the end of 2010. In February 2011, it introduced 9 PEs including Henan Venture Capital, Guoxin Hongsheng, Nanjing Longyi Investment, Tianjin Changan Innovation PV Investment, Tianjin Heguang Vision, Tianjin Tongyixin Energy Investment, Henan Huihe Investment, Tianjin Heguang Chuangzhan Investment, Shenzhen Tongsheng Venture Capital. It is worth noting that the financial adviser to the restructuring of Xindaxin Materials is Guoxin Securities, and Guoxin Hongsheng, a direct investment subsidiary of Guoxin, is also on the PE list. "The policy does not allow direct investment after sponsorship, but Guoxin is doing it in reverse, or it is licensed. However, this time through restructuring rather than IPO, it is rare in the market," a Shanghai investment bank told reporters. . In fact, the previous sponsor of Xindaxin Materials has been Hualin Securities. According to the regulations, the GEM listed companies should continue to supervise the sponsors for 3 years, but the new and new materials are only listed for more than 2 years. Hualin Securities should continue to supervise the period, for what reason, new and new materials Restructuring is to find another financial consultant? "Reorganization now, the right to speak is in Henan SASAC, and has little to do with the original company. Guosen Securities may have to help Yicheng new materials to go public, and now it is reorganized, the list will be shunned. After all, the restructuring is very complicated, China Lin is still a small broker, and Guoxin has more experience," the analyst told reporters. Surprisingly, Pingmei Shenma rarely promised in the announcement that if the company's share price is less than 10 yuan/share within 10-15 months after reorganization, the major shareholder will increase its holdings, which can almost be regarded as New big new material support plate. In fact, the lock-up period of 11 PEs is 12 months. According to the agreement, they will subscribe for the company's new shares at 6.41 yuan/share. The major shareholder made such a commitment and buried the PE for lifting the ban one year later. Foreshadowing.

On December 9, Xindaxin Materials announced a major asset restructuring announcement, intending to issue 139 million shares to all shareholders of Yicheng New Materials at a price of 6.41 yuan/share to purchase 100% equity of Yicheng New Materials. Yicheng New Materials' controlling shareholder is China Pingmei Shenma Group under the Henan State-owned Assets Supervision and Administration Commission. After the completion of the restructuring, Pingmei Shenma Group's shareholding in Xindaxin Materials will reach 19.42%, and Henan State-owned Assets Supervision and Administration Commission will become the new Daxinxin The actual controller of the material. This is another case after the LDK and Dongying PV, another state-owned PV company. However, this country's retreat is not only a typical portrayal of the industry, it involves investment banks, PE interests, but also reflects the ecology of the capital market. Private enterprises plant rice, and state-owned enterprises harvested New and new materials listed in the market for two years, they will encounter a change. Private enterprises plant rice, and state-owned enterprises harvest. The clock dialed back two years ago, and the new big new materials are infinite. In June 2010, the new big new material wearing the "GEM photovoltaic concept first stock" aura hit the Shenzhen Stock Exchange, not only issued price of up to 43.4 yuan / share, the price-earnings ratio also reached 68.89 times. "When the photovoltaic industry was first launched, private enterprises were rushing to make it more expensive, and they were willing to pay more to expand the scale." A senior executive of an energy company told reporters. “Let's save money and expand the scaleâ€, the private enterprise seems to be “quick and quickâ€. In the photovoltaic industry, the company's profits can indeed grow by leaps and bounds. However, once the market goes down, it may be a devastating blow. According to the announcement of Xindaxin Materials, it raised 1.52 billion yuan when it was listed, of which over-raised funds amounted to 1.01 billion yuan. Last year, when the PV market saw a decline in the price of crystalline wafers and the downstream demand was sluggish, Xinda New Materials decided to use 590 million yuan of super-raised funds to build three new production lines to expand production capacity. "The original intention was to expand production and increase the price, but the market is getting worse. The photovoltaic industry is high in energy consumption, and the cost investment will be great. If the profit can't keep up, the loss will be inevitable." Beijing A new energy analyst told reporters. As of the third quarter of this year, the operating income and net profit of Xinda New Materials were 672 million yuan and 3.02 million yuan respectively, a year-on-year decline of 53.88% and 97.86%. The performance was huge, and the private enterprises subsequently transferred to the state-owned enterprises. On the surface, the state-owned enterprises ate a property that was not high-quality, but in fact the role played by the state-owned enterprises was matched with the participants and the shadow referee. “The government used to encourage private enterprises to develop photovoltaics and subsidize them. As a result, everyone rushed to the top and the production capacity was seriously oversupplied. The current situation is that the state encourages state-owned enterprises to integrate, although the benefits will not change greatly in the short term, but in the long run After the integration, the concentration will increase, and the government will have policies to support it. In the end, it will still earn," the analyst told reporters. In fact, the assets that Henan SASAC has to inject into new materials have been competitors of new and new materials for many years. From the announcement, Yicheng Xincai's main business is crystalline silicon wafer cutting blade, which is the same as Xindaxin, not only in Henan, but also the largest photovoltaic cutting edge production company in China. Over the years, the two companies have adopted a strategy of lowering prices in order to increase market share, which directly led to a decline in performance.